How to Open a Trading Account on Vantage Markets Step-by-Step

Opening a trading account on Vantage Markets is one of the smartest decisions for anyone looking to enter the world of online trading. Whether you are new to trading or already have some experience, Vantage Markets provides an easy-to-use, secure, and powerful trading platform that allows traders to explore global financial markets. The platform is known for its competitive spreads, advanced tools, and strong regulatory framework, making it one of the preferred brokers among both beginners and professionals.

In this detailed guide, you’ll learn exactly how to open a trading account on Vantage Markets step-by-step, along with insights on how to verify your account, deposit funds, and start trading confidently. By the end of this article, you’ll have all the information you need to begin your trading journey successfully.

Understanding Why Vantage Markets Is a Popular Choice for Traders

Before jumping into the registration process, it’s important to understand why so many traders choose Vantage Markets over other brokers. Founded in 2009, Vantage Markets has built a strong reputation for reliability, transparency, and technological excellence. The platform offers access to a wide range of financial instruments, including forex, commodities, indices, shares, and cryptocurrencies.

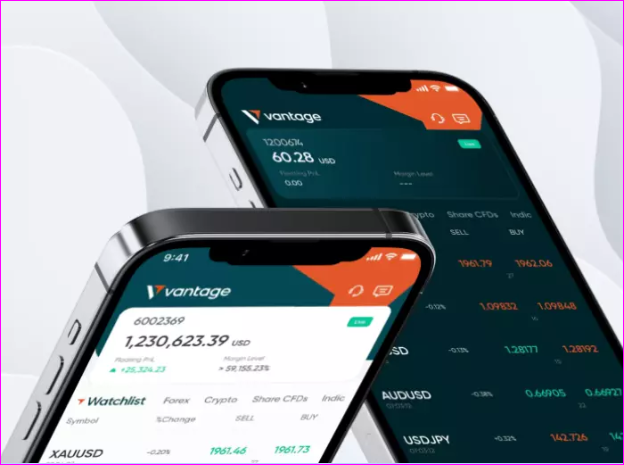

One of the major advantages of trading with Vantage Markets is its user-friendly interface combined with institutional-grade tools. Whether you prefer MetaTrader 4 (MT4), MetaTrader 5 (MT5), or the proprietary Vantage App, the platform ensures a smooth and intuitive trading experience. Traders appreciate its fast execution speeds, low latency, and access to advanced charting tools for technical analysis.

Vantage Markets also stands out for its strong regulatory status. The broker is regulated by several trusted authorities, including the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA) in the UK. This ensures that client funds are held securely and that all operations follow strict compliance standards.

Additionally, Vantage Markets provides educational resources, webinars, and market analysis, helping new traders build knowledge and confidence. Combined with competitive leverage, low commissions, and a variety of account types, it’s easy to see why Vantage Markets has become a leading name in global online trading.

Step 1: Registering an Account on Vantage Markets

The first step to opening your trading account is registration. The process is designed to be straightforward and can be completed in just a few minutes.

To begin, visit the official Vantage Markets website. On the homepage, you’ll see a “Create Account” or “Join Now” button—clicking it will take you to the registration page. Here, you’ll be asked to provide some basic information such as your full name, email address, phone number, and country of residence. You’ll also need to create a strong password to protect your account.

After submitting these details, you’ll receive a confirmation email from Vantage Markets. This verification email contains a link that activates your account. Once your email is verified, you can log in to your personal client portal and continue with the account setup process.

It’s essential to provide accurate information during registration because this data will be used later for identity verification. The registration process is fully encrypted to ensure your personal data remains safe and private.

Once your basic account is created, you can choose between different account types depending on your trading goals and experience level. Vantage Markets offers Standard STP, Raw ECN, and Pro ECN accounts—each with different commission structures and spreads. Beginners often start with the Standard STP account because it has no commission fees and provides access to all major markets.

Step 2: Verifying Your Account with Vantage Markets

After registering, the next important step is account verification, also known as KYC (Know Your Customer) verification. Vantage Markets follows strict regulatory guidelines to protect traders and prevent fraudulent activity, so completing this step is mandatory before you can start trading or withdrawing funds.

In your client portal, you’ll find an option labeled “Verify Your Account.” You’ll be asked to upload identification documents such as a government-issued ID (passport, driver’s license, or national ID card) and proof of address (such as a utility bill or bank statement issued within the last three months).

The verification process usually takes between a few hours to one business day, depending on how quickly the documents are reviewed. Vantage Markets’ compliance team ensures that all documents meet international security and compliance standards.

Once your account is verified, you’ll gain full access to all trading features. Verification not only helps you secure your account but also enhances trust between you and the broker. It allows you to withdraw profits seamlessly and ensures that your trading experience remains transparent and compliant with financial regulations.

In addition, verified traders may enjoy certain benefits such as promotional bonuses, access to exclusive webinars, and faster customer support assistance. Therefore, completing the KYC process as soon as possible is recommended to unlock your account’s full potential.

Step 3: Making a Deposit and Setting Up Your Trading Platform

After your account is verified, the next step is to deposit funds and set up your trading platform. Vantage Markets makes this step incredibly flexible, offering a wide range of payment methods suitable for traders around the world.

You can fund your account using debit or credit cards, bank transfers, e-wallets like Skrill and Neteller, or even cryptocurrencies depending on your region. The minimum deposit requirement varies by account type, but it’s typically around $50, making it accessible for beginners.

All deposits are processed through secure payment gateways, ensuring that your funds are transferred safely. In most cases, deposits are credited instantly, allowing you to start trading without delay.

Once your funds are available, the next task is to set up your trading platform. Vantage Markets supports MetaTrader 4, MetaTrader 5, and its proprietary Vantage App. You can download these platforms directly from the website or your client portal. After installation, log in using your trading account credentials provided during registration.

Within the trading platform, you’ll have access to real-time market quotes, charts, and indicators. You can customize your layout, set up trading templates, and explore different timeframes to suit your trading style.

Vantage Markets also offers a demo account feature that allows you to practice trading with virtual funds. This is an excellent way for new traders to test strategies, understand platform functions, and gain confidence before trading with real money.

Step 4: Exploring Trading Instruments and Strategies on Vantage Markets

Now that your account is funded and set up, it’s time to explore the wide variety of instruments available for trading. Vantage Markets provides access to global financial markets, including forex pairs, commodities, indices, stocks, ETFs, and cryptocurrencies.

Forex trading is one of the most popular categories on Vantage Markets, offering tight spreads and fast execution speeds. Traders can choose from major pairs like EUR/USD, GBP/USD, and USD/JPY, as well as minors and exotics. The platform also provides leverage options, allowing traders to control larger positions with smaller capital.

For those interested in diversifying their portfolio, Vantage Markets also offers opportunities in commodities such as gold, silver, and crude oil. These assets are often used as hedges during market volatility. Index trading allows traders to speculate on the performance of global stock markets such as the S&P 500, FTSE 100, and NASDAQ.

Vantage Markets is also known for its educational tools and market insights. The platform regularly updates traders with daily analysis, webinars, and expert commentary. By leveraging these resources, traders can develop effective strategies and make informed decisions.

Risk management is another crucial part of trading, and Vantage Markets equips traders with tools like stop-loss and take-profit orders. These features help limit potential losses and lock in profits automatically. The broker also offers copy trading options, enabling beginners to follow and replicate the strategies of experienced traders.

By combining Vantage Markets’ powerful features with disciplined trading practices, you can build a sustainable and rewarding trading experience.

Step 5: Withdrawing Profits and Managing Your Account Effectively

Once you’ve started trading successfully, you’ll eventually want to withdraw your profits. Vantage Markets offers a smooth and secure withdrawal process designed to protect your funds and ensure transparency.

Withdrawals can be made using the same method you used for your deposits, which helps maintain financial security. Simply log into your client portal, go to the “Withdraw Funds” section, select your preferred method, and enter the amount you wish to withdraw. The broker processes most withdrawal requests within 24 hours, although bank transfers may take a few business days depending on your financial institution.

It’s important to note that withdrawals are only available to verified accounts, another reason why completing your KYC early is crucial.

Managing your account efficiently involves keeping track of your trading performance, managing risk, and staying updated with market news. Vantage Markets provides a detailed account dashboard where you can review transaction history, open positions, trading volume, and account balance.

Traders should also take advantage of the platform’s advanced analytical tools and trading calculators to measure potential risks and rewards before opening a position. Setting realistic goals, using proper risk management, and continuing to educate yourself through Vantage Markets’ resources will contribute to long-term trading success.

Another advantage is that Vantage Markets offers 24/7 customer support through live chat, email, and phone. The support team is responsive and knowledgeable, ready to assist you with technical or account-related inquiries. This ensures that you always have professional assistance available whenever needed.

The Importance of a Regulated and Transparent Broker

One of the most critical aspects of online trading is choosing a trustworthy and transparent broker. Vantage Markets has earned its credibility by adhering to global financial regulations and maintaining a high level of transparency in all its operations.

As a regulated broker under ASIC, FCA, and other authorities, Vantage Markets segregates client funds in top-tier banks, ensuring that your money is always protected. This means the broker cannot use your deposits for its operational expenses, a key factor in safeguarding trader interests.

In addition to regulation, Vantage Markets maintains strong data encryption and multi-factor authentication measures to prevent unauthorized access. This combination of compliance and technology builds confidence among traders worldwide.

Transparency also extends to trading conditions—Vantage Markets clearly displays its spreads, commissions, and swap rates, allowing traders to make informed decisions. The broker avoids hidden fees and ensures that order execution remains consistent with its advertised standards.

Furthermore, Vantage Markets invests heavily in customer education and community engagement. Through blogs, webinars, and tutorials, it empowers traders with the knowledge needed to navigate the markets effectively. Such dedication to trader growth reflects the broker’s long-term commitment to client success.

Continuous Learning and Improving as a Trader

Opening a trading account on Vantage Markets is just the beginning of your journey. To succeed in trading, continuous learning is essential. Markets are constantly evolving, and strategies that work today may not work tomorrow. Vantage Markets provides numerous resources that help traders stay informed and improve their skills.

The broker’s education center includes beginner guides, advanced strategy lessons, and video tutorials. It also offers weekly market analysis, helping traders understand trends, economic events, and potential opportunities.

Experienced traders can access tools like VPS hosting, algorithmic trading support, and API integrations, enabling them to automate and optimize their trading strategies.

By combining these tools with discipline, emotional control, and sound risk management, you can improve your performance and achieve consistent results over time.

Remember that trading involves both opportunities and risks. Using Vantage Markets’ demo account to test strategies, reviewing performance data, and learning from both wins and losses will help you become a more effective trader in the long run.

Conclusion

Opening a trading account on Vantage Markets is a simple yet strategic move for anyone ready to explore the global financial markets. The process—from registration and verification to depositing funds and placing trades—is designed for efficiency, security, and ease of use. With its robust trading platforms, advanced tools, and commitment to transparency, Vantage Markets empowers traders to take control of their financial future.

Whether you’re a beginner or a seasoned trader, the key to success lies in continuous learning, proper risk management, and using the wide range of resources available through Vantage Markets. By following the step-by-step process outlined in this guide, you’ll be well-prepared to start trading confidently and effectively on one of the most trusted platforms in the industry.